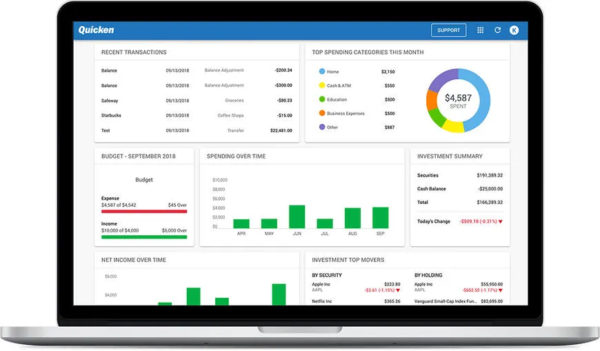

It’s likely that you’ll have to alter some of your spending categories manually. It will also categorize your expenditures for you, but it isn’t a flawless science. Mint will connect to your account immediately and keep track of your spending. Keep track of your earnings and expenses.As a result, you won’t have a complete picture of your finances. It also doesn’t have a running registry because it relies on banks to settle any outstanding costs. You can’t, for example, export a CSV file of your transactions and import it into Excel. Mint has more limits than Quicken because it is free. Over 20 million people use Mint to better understand their finances. Quicken will allow you to review your portfolio and keep track of your investments. Quicken is a program that helps you to keep track of all of your investments in one spot. You’ll never forget another bill again! Receive notifications and see your bills before they’re due. If you want Quicken to effortlessly add your costs to your budget, this is the way to go. Set a yearlong budget with ease and measure your success month by month. Alternatively, you can enter your transactions manually into the application.

You are under no obligation to connect your account to Quicken. All you have to do is set up your categories ahead of time, and Quicken will take care of the rest! Quicken will automatically categorize your expenses so you can see how much money you’re spending on each category in your budget. Quicken’s most popular feature is without a doubt this.

Quicken mint software#

You’ll have a decent handle on your money and where it’s going, even if you only use half of what this software has to offer. The good news is that you don’t have to use everything Quicken has to offer. They have so many alternatives, in fact, that it may be a little daunting. Quicken includes a lot of features that can help you arrange your personal finances. let’s take a quick look at the features and differences between Mint and Quicken. Since we have known a little about Mint and Quicken. Quicken has an internet component that makes it mobile-friendly. It will also need to be updated regularly.

Quicken mint download#

You’ll need to download Quicken to your computer because it’s a software program. Budgeting, bill pay, an investment tracker, and property and business accounting tools are among the many financial tools available. Quicken is a desktop application that requires a subscription. It enables users to merge all of their finances in one location and accomplish chores that were previously completed on paper more rapidly. Quicken is the grandfather of personal finance software, having been created by Intuit in 1983. They also profit when a user enrolls in a sponsored service, such as a credit card or a bank account. So, because Mint is free, you can expect to see advertisements on the app and on the website. Mint connects to nearly every bank in the United States, allowing you to see virtually any account you have with a single click.įurthermore, Mint syncs with your accounts automatically, giving you a complete view of how much money you have in all of your accounts at once.

Quicken mint free#

Users can connect all of their accounts in one spot with this free app and website.

This means they’ve had plenty of time to figure out what their customers want. Mint debuted in 2006 and instantly earned the moniker “Quicken killer.” For years, it has been the most popular personal finance app. Hopefully, this will help you decide which financial tool is best for you. Read this review to find out the difference between Quicken vs.

0 kommentar(er)

0 kommentar(er)